The U.S. Congress is poised to debate this week a $1.15-trillion government spending bill and a $650-billion package of tax breaks that negotiators tentatively embraced late on Tuesday, which also includes repealing a 40-year-old ban on oil exports.

If approved by the Republican-controlled House of Representatives and Senate, with voting as early as Thursday, federal agencies also would receive beefed up funding through September 2016 for military and domestic programs.

Some hardline conservative Republicans are expected to balk at the funding bill.

Representative Tim Huelskamp, a frequent critic of past Republican fiscal measures, noted that the latest one fails to stop funding for women’s health care provider Planned Parenthood—a target of anti-abortion forces—and does nothing to stop President Barack Obama’s program to bring thousands of Syrian refugees to the United States.

“As I see it (the bill) now … no, I’m not planning on supporting it,” Huelskamp told reporters late on Tuesday.

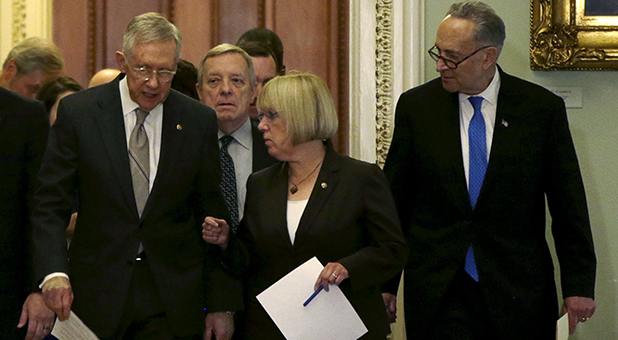

A senior Senate Democratic aide told Reuters the legislative language was being reviewed to make sure it “reflects the negotiations.”

Representative Ann Wagner confirmed that in return for a repeal of the oil export ban, Democrats won temporary tax breaks to boost wind and solar development, an important priority for Obama in the aftermath of a Paris climate change deal that calls for significant global reductions in carbon dioxide emissions.

Other elements of the two bills that are expected to move through Congress in coming days, according to Republican lawmakers, include:

– A $650-billion package extending a package of tax breaks over 10 years, with $560 billion of the total in permanent extensions, including for business research and development.

Many Democrats are expected to oppose this measure, saying it costs too much and is too heavily skewed toward corporate interests. But it does include a provision Democrats sought, making a child tax credit permanent.

– Changes to a visa waiver program that will tighten travel curbs on those who have been in Iraq and Syria;

– No “bailout” for Puerto Rico, which is experiencing fiscal difficulties;

– Provisions to encourage companies to share cyber data with the U.S. government in its fight against hackers;

– The “179” deduction, a tax break small business owners use to buy new equipment, is being made permanent;

– A two-year delay in a 2.3 percent excise tax on medical devices and a “Cadillac tax” on high-cost health care plans. Representative Tom Cole said the tax package also would include a one-year delay in a tax on health insurance providers.

He said it also extends for another year a provision limiting how much the government can spend on “risk corridors” protecting insurers against financial losses under Obama’s landmark healthcare law;

– A five-year renewal of a program to help first responders and others who suffered illness from exposure to toxins at the World Trade Center site destroyed in the 9/11 attacks.

Before Congress debates these long-term bills, it is expected on Wednesday to pass another stop-gap funding bill giving lawmakers until Dec. 22 to complete their work. Without the temporary measure, federal funding for a range of government programs expires at midnight on Wednesday.

A congressional aide said negotiators were likely to block a proposal to revise certain legal protections for bondholders, a provision that had been pushed by Senate Democratic leader Harry Reid, partly to ease the bankruptcy of casino giant Caesars Entertainment’s operating unit.

(Reporting by Susan Cornwell; Editing by Clarence Fernandez)

© 2015 Thomson Reuters. All rights reserved.

See an error in this article?

To contact us or to submit an article