Since 2011, Scambook has received approximately 200 complaints related to IRS phishing. Therefore, the complaint resolution platform is warning consumers about identity theft and IRS phishing scams for this year’s tax season.

Here are 10 tips that can help you file your taxes safely to avoid identity theft this year:

- Know who’s helping. Work with someone familiar and, more importantly, trustworthy. If you are thinking of hiring a new accountant or commercial tax preparer, conduct proper research online. Be sure to read all reviews carefully, and check for business complaints on Scambook.com.

- File your taxes ASAP. Filing sooner rather than later gives identity thieves less time to file tax returns using stolen Social Security numbers.

- Mail your taxes personally. Don’t put your taxes in others’ hands. Mail the information directly at the post office to cut out the middleman.

- Use a secure Wi-Fi connection to e-file. If filing through TurboTax or another online program, be sure to send personal information through a secure, password-protected wireless Internet connection. Public Wi-Fi should not be used.

- Save files to a CD or flash drive, then delete the computer files. If you’re e-filing, make sure to use a strong password to protect the data file. Save the file to a CD or flash drive, and then delete the personal return information from your hard drive. Store the CD or flash drive in a safe place, such as a lockbox or safe.

- Watch out for IRS email scams. An “IRS email” is a huge red flag because the IRS does not contact the public electronically to request personal or financial information. Proper notification for personal information will only be sent to you through regular mail.

- Report IRS phishing emails and fraud sites. If a website claims to be the IRS but the URL fails to begin with irs.gov, be very careful because it might be fake. There are a few exceptions, like apps.irs.gov, but in general, all pages related to the IRS begin with irs.gov. If a suspicious website claims to be the IRS or you receive a fake IRS email, report it by emailing [email protected].

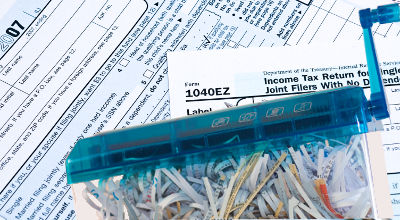

- Shred hard copies of documents once they’re unnecessary. Use a cross-cut paper shredder for old tax documents when they’re no longer needed. Cross-cutters are more secure than regular strip-cut shredders. Don’t discard old documents without shredding. Identity thieves often go dumpster-diving for personal information right after tax season ends.

- Check your mail ASAP. If you’re expecting a refund or other information after your taxes are filed, make sure to check the mail every day. Don’t leave it sitting in the mailbox. Have a friend pick up your mail, or arrange for it to be held at the post office if you’ve got an out-of-town trip scheduled.

- If you suspect you’re a victim of identity theft, take action right away. If you believe yourself to be a victim of identity theft, where someone else has used your Social Security number to file a tax return, get IRS Form 14039 and send it in immediately. Also file an “initial fraud alert” with one of the big three credit reporting agencies (Experian, Equifax or TransUnion), as well as an identity theft report on ftc.gov.