The U.S. House of Representatives’ top tax writer wants a vote this year on legislation moving the United States to a territorial-style tax system aimed at exempting the earnings of American companies abroad from U.S. taxation.

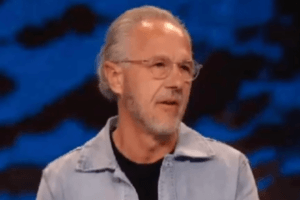

International tax reform should be tackled as the first step toward a bigger rewrite of the U.S. tax code that would lower rates and eliminate many narrow tax breaks, House Ways and Means Committee Chairman Kevin Brady told Reuters in an interview on Friday.

Brady, a Texas Republican who took over the committee’s gavel in November, said he favors a U.S. corporate tax rate of less than 20 percent, substantially lower than the current top rate of 35 percent.

“My intention is to have a vote on an international tax proposal out of Ways and Means this year,” Brady said.

U.S. companies have been pushing for the United States to move to a territorial tax system to make them more competitive against foreign rivals that pay taxes only in local jurisdictions where they operate.

The United States government taxes corporate profits earned abroad only when they are brought into the country. Some $2 trillion in U.S. profits are sheltered overseas to avoid taxation, and Brady said he wants to find a way to “lower the barriers and allow companies to bring back their profits to be invested in the United States.”

He said that an international reform proposal by former Ways and Means chairman Dave Camp for a one-time “holiday” taxing companies on foreign profits held overseas at a far lower rate is “an awfully good place to start.”

Camp, who has retired from the House, favored taxing repatriated cash profits at 8.75 percent and remaining earnings at 3.5 percent.

Brady said that a broad “pro-growth” tax reform plan would require a Republican president and was a project for 2017. He said a bipartisan consensus was building for reform, to prevent U.S. firms from moving headquarters overseas.

Brady also said he was not yet ready to declare whether he supported the Trans-Pacific Partnership (TPP) trade deal because the pact reached in October needs more study.

Although Senate Majority Leader Mitch McConnell has been quoted as saying he would prefer to delay voting on TPP until after the November 2016 elections, Brady declined to rule out a vote earlier in the year. The timing would largely depend on member support for the deal, he said.

“Let’s not delay or hasten the timetable for a vote,” he said.

(Editing by Grant McCool and Bill Trott)

© 2015 Thomson Reuters. All rights reserved.

See an error in this article?

To contact us or to submit an article